[ad_1]

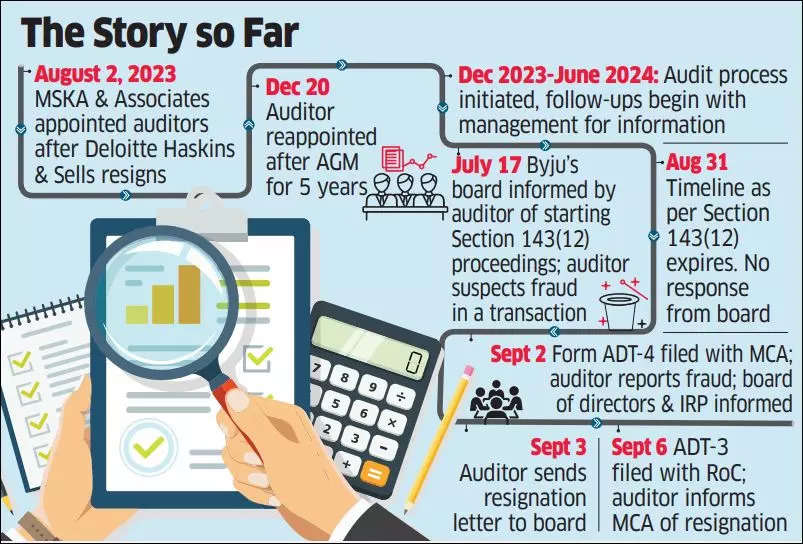

Mumbai: MSKA & Associates, the audit firm of embattled edtech startup Byju’s, has informed the company’s board of its resignation as statutory auditor with immediate effect, said two people aware of the development.

This will affect the firm’s audit for FY23 accounts. It had been appointed for a five-year term ending FY27.

In the resignation letter, the auditor also cited a suspicious transaction related to Dubai-based reseller More Ideas General Trading LLC that had been reported to the ministry of corporate affairs (MCA) on September 2, said the people quoted above. This involves recovery of about ₹1,400 crore from the reseller. ET had reported February 19 that investors in Byju’s had raised red flags over the management’s failure to recover dues in this particular transaction.

Byju’s and MSKA & Associates hadn’t responded to queries as of press time.

MSKA reportedly took the decision to quit due to management’s uncooperative attitude, difficulty in getting numbers and details required to conduct a proper probe, and a matter coming to light that had to be reported to MCA as per Companies Act.

MSKA & Associates is the second audit firm to resign from Byju’s in a little over two years, following Deloitte Haskins & Sells’ exit on June 23, 2022. The Byju’s board had first appointed MSKA & Associates on August 2, 2023, to fill the casual vacancy that opened up as a result.

The firm was re-appointed on December 20, 2023, as the statutory auditor of the company at the AGM for a five-year term, from FY23 to FY27.

‘Lack of Information’

In its audit report for FY22, MSKA had reported a “material uncertainty” over the company’s status as a “going concern”. The audit firm reportedly struggled to obtain the necessary books of accounts, information and audit evidence, despite multiple attempts and reminders between January and June this year, said the people cited.

The audit firm sought the board’s intervention but to no avail, leading to a situation where it could not complete the FY23 audit.

The people cited above said a key concern was the lack of critical information regarding the inability to recover dues from More Ideas General Trading LLC in Dubai, as well as the failure to initiate a forensic review of this transaction, despite repeated requests.

In the past months, the auditors had repeatedly warned about the management’s failure to recover approximately₹1,400 crore from the Dubai-based reseller while paying out ₹300 crore in sales commissions, even as the debt-laden edtech firm faced a severe fund crunch.

As a result, in accordance with its duties, the statutory auditor had to start proceedings under Section 143(12) of the Companies Act, 2013, and informed the board in mid-July. Under Section 143 (12), an auditor has to inform the Registrar of Companies (RoC) if it comes across suspected fraud.

However, since it did not receive a response from the management or the board by the end of August, the auditor reported the suspicious transaction to the central government, as it’s required to.

As a final step, the auditor filed Form ADT-3 with the RoC on September 6, according to the people familiar with the matter. Form ADT-3 is a mandatory report that has to be filed when an auditor resigns before the completion of its term.

The people cited above said that the lack of information led to significant delays and ultimately prevented the financial statement for FY23 from being completed and delivered to shareholders by the September 30, 2023, deadline under the Companies Act, 2013.

Byju’s was also facing investigations by government agencies such as the Enforcement Directorate (ED) and the revenue department, which could have a material impact on its business. But the management did not keep the auditor updated on litigation notices and regulatory communications from government authorities, leaving it without complete information needed to conduct the audit, said the people cited.

The auditors are also reported to have informed the board that due to ongoing litigation with lenders, the company had lost control over certain subsidiaries, and management no longer had access to their books of accounts, an added hurdle to the completion of consolidated financial statements.

After MSKA took over the audit in August 2023, Byju’s parent company, Think & Learn Pvt Ltd, reported a consolidated loss of Rs 8,245 crore on operating revenue of Rs 5,014 crore for the fiscal year ended March 31, 2022. This regulatory filing, submitted in January 2024, came after multiple missed deadlines over the past year.

[ad_2]