[ad_1]

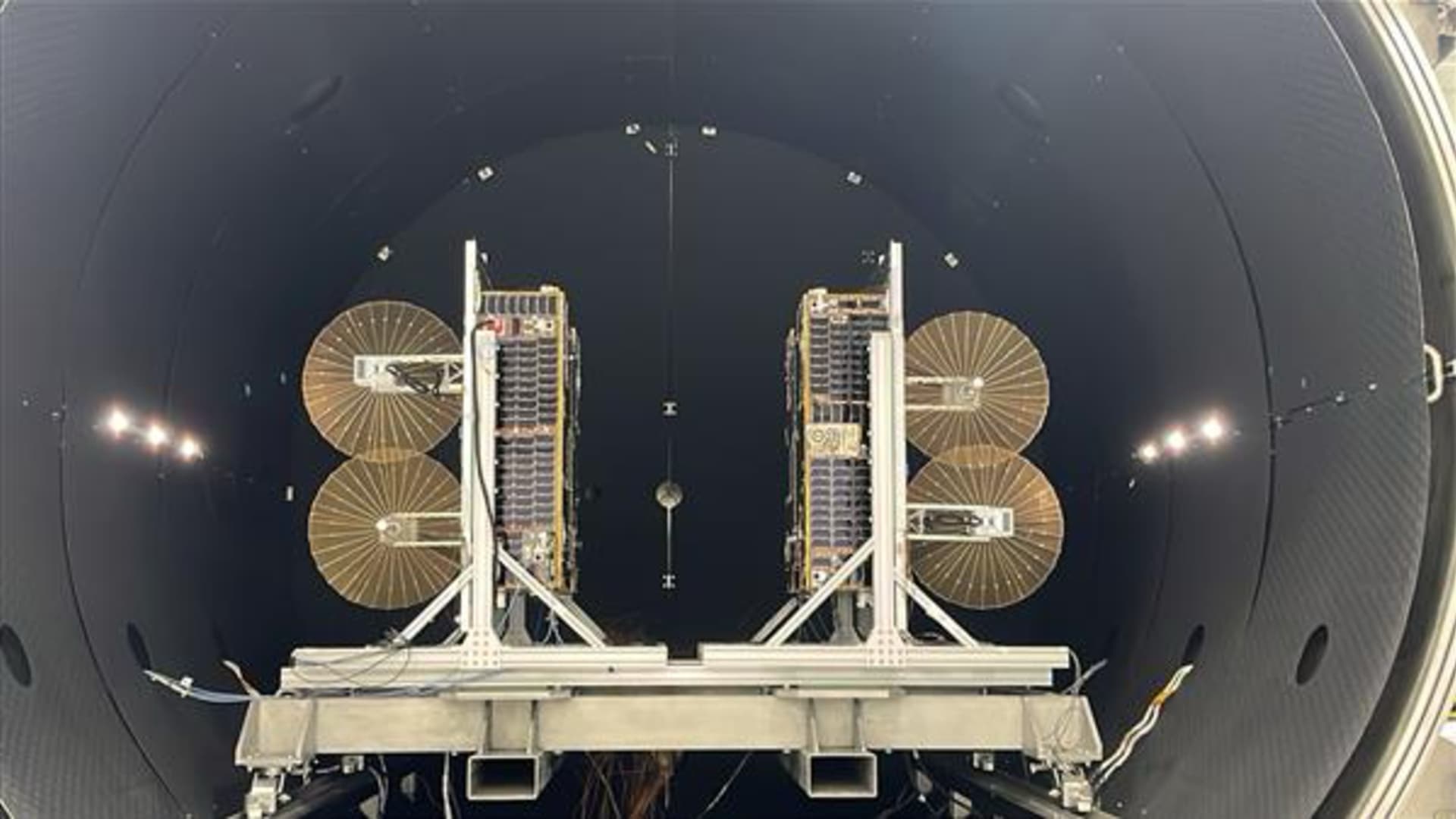

Shares of AST SpaceMobile could soar into the stratosphere, according to Deutsche Bank. The bank reiterated its buy rating on shares of the satellite manufacturer. Simultaneously, analyst Bryan Kraft hiked his price target to $63 from $22. Shares of AST have already popped a whopping 404% this year. Kraft’s updated forecast is approximately 114% higher than the stock’s Tuesday closing price of $29.41. As a major catalyst, Kraft pointed to AST’s timeline for its service availability and satellite launches, the first of which is forecast for September. Deutsche Bank anticipates another four commercial satellites to launch in 2024, followed by 20 in 2025, 30 in 2026 and 40 in 2027. Between 45 and 60 satellites would provide full continuous customer service to countries in the Northern latitudes, while the full 90 satellites would provide full worldwide coverage. ASTS YTD mountain AST’s stock year to date “We do think there could be some equatorial service introductions prior to 2027 as satellite coverage expands, however, we’re leaving that as potential upside to our estimates,” Kraft wrote. “We’re forecasting positive EBITDA in 2026 at $221M, increasing to $4.9B in 2030; with [free cash flow] turning positive in 2027.” Kraft added that AST’s balance sheet looks stable at the moment, with enough cash to fund its business plan through 2025. The analyst also highlighted AST’s large total addressable market, to which he attributed the company’s “steep ramp in revenue that we’re assuming.” “We’re using a current TAM of 284M mobile users for Northern Hemisphere supplemental coverage and 1.6B unconnected peoples for whom AST could offer a primary broadband service in the future,” he noted. “This large TAM equates to significant optionality with respect to upside growth scenarios.” — CNBC’s Michael Bloom contributed to this report.

[ad_2]